Many urgent care centers use outdated and fragmented payment systems that are anything but consumer-centric. Not only do these legacy systems confuse and frustrate patients, they can also contribute to lower collections, longer days in AR, and lost revenue.

By better understanding patient preferences and streamlining the financial payment process, urgent cares can ensure faster, more reliable revenue streams and a better overall patient experience.

Read on to learn more about four leading issues with patient payments today, and how urgent cares can leverage consumer-centric technology to adapt.

Lack of Price Transparency

The problem: When patients visit a healthcare provider today, they often have no idea how much their services will cost. This lack of transparency around pricing can be extremely frustrating and stressful, and even deters some people from seeking care.

Fears around healthcare costs are mounting, too — 35% more patients are concerned about healthcare affordability today than in 2019. InstaMed research shows that 75% of consumers with health insurance are worried about financial hardship due to medical costs. This isn’t entirely surprising given that 87% of Americans have been surprised by a medical bill in the past year.

The solution: In a time where around 90% of consumers are eager to know about their healthcare costs upfront, urgent care clinics need to implement technology that improves price transparency — such as cost estimation tools that are available at the time of booking.

Patient Confusion and Dissatisfaction

The problem: Patients today are more confused about insurance coverage and medical bills than ever before. More than 35% of adults have a difficult time understanding what their insurance covers. And many urgent care centers wait to discuss insurance coverage and bills when the patient arrives at the clinic. Not only is this stressful, but it’s also frustrating and can create tension between patients and administrative staff at the time of visit. According to InstaMed, more than 75% of providers report that billing and collections impact the patient experience.

The solution: Urgent care centers must improve their communication and patient education strategies related to payment processes. Better understanding patient preferences and adopting consumer-centric payment technology drives better outcomes for everyone involved.

Operational Challenges in Collecting Payments

The problem: Many urgent care clinics struggle to collect patient responsibility due to manual billing and collection processes and other outdated systems that complicate payments. More than 50% of providers mail paper statements to collect patient responsibility after a healthcare visit. The process is similar for issuing refunds, with 79% of providers issuing refunds through a paper check. Unfortunately, most consumers today are not all that interested in receiving paper statements by mail.

The solution: Urgent care centers need to leverage consumer-centric technology that facilitates efficient billing and collection processes. For example, digital technology that gives patients the option to pay for their visit upon booking, at the time of their visit, or immediately following — all with just a few clicks. Another option is to adopt a patient payment solution that allows patients to upload their credit card information during the registration process, long before they arrive in your clinic.

Long days in AR and Bad Debt

The problem: Around 30% of urgent care revenue comes from patient payments. This means that when patients are slow to pay their bills — which is common — urgent care clinics take a hit. Typically, somewhere around 14% of that revenue can be lost to bad debt when patients don’t pay their bills. Research shows that patients are actually 50% less likely to pay once they leave your clinic’s doors, amounting to large amounts of lost revenue. Given that medical bills often arrive more than a month after each healthcare visit, many patients have simply moved on by that point.

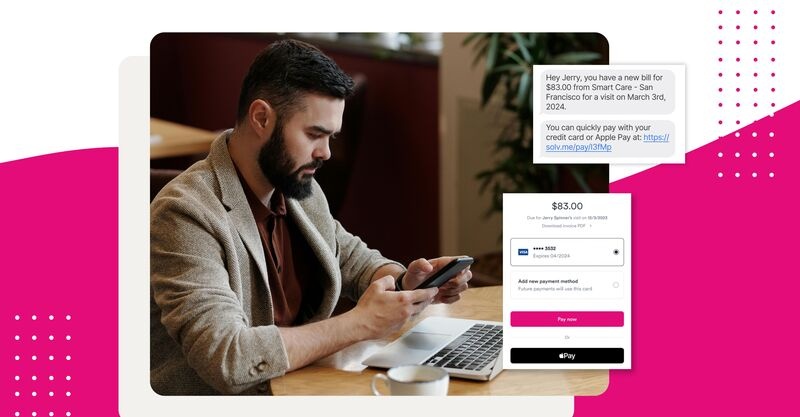

The solution: Patients today need options to pay digitally and in a much more timely manner. This could include mobile checkout, storing credit cards on file and automatically collecting at the time of visit, or sending bills via text message with options to pay directly.

Key Takeaways

- Patient payments are an extremely complicated aspect of today’s healthcare landscape, but there are many opportunities for improvement.

- Streamlining the payment processes with innovative patient payment solutions can help, urgent care clinics improve the patient experience and ensure a faster and more reliable revenue stream.

- Today’s payment challenges can be solved with consumer-centric payment technology that offers pricing transparency and allows patients to pay for their visit at the time of booking, arrival, or with just a few clicks after their visit.

LinkedIn

LinkedIn